The European Union’s Carbon Border Adjustment Mechanism (CBAM) is more than just another regulation—it marks a paradigm shift in global trade. For exporters in Turkey, the UAE, and other non-EU countries with energy-intensive industries, CBAM introduces new carbon-related costs, transparency obligations, and strategic pressure to decarbonize

What is CBAM?

CBAM is a climate policy tool introduced by the EU to level the playing field between EU-based manufacturers and foreign producers.

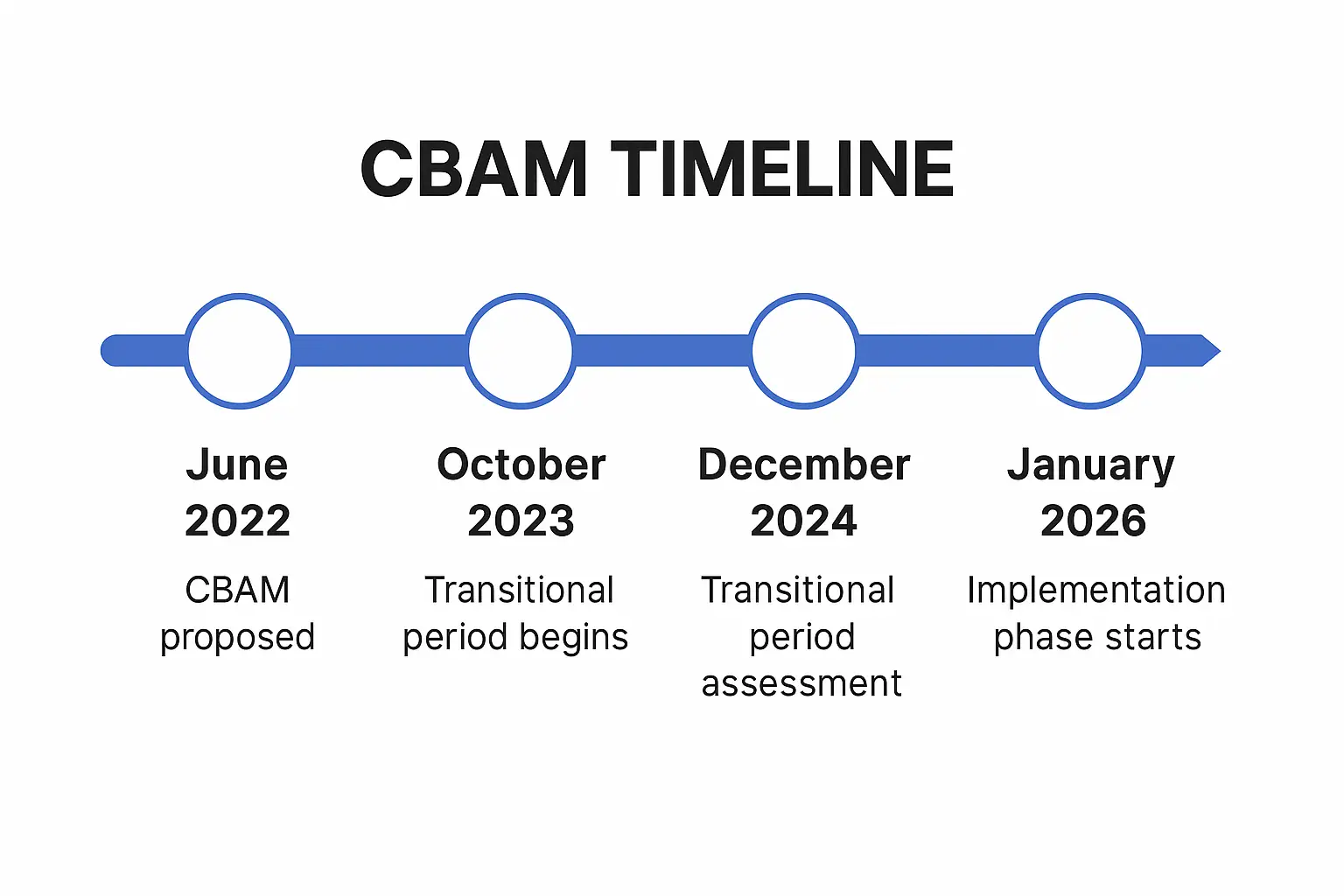

Starting in 2026, importers of certain goods into the EU must declare the embedded CO₂ emissions of their products and purchase CBAM certificates, priced similarly to the EU Emissions Trading System (EU ETS).

The goal: Prevent carbon leakage and drive global decarbonization through fair carbon pricing

Which Products Are Affected?

In its initial phase, CBAM applies to:

- Steel and Iron

- Aluminium

- Cement

- Fertilizers

- Electricity

- Hydrogen

More sectors such as chemicals, glass, plastics, or textiles may follow in future phases

Who Is Impacted?

Exporting companies in:

-

Turkey, with major steel, cement, and aluminium exports to the EU

-

UAE and GCC countries, where electricity-related emissions are relatively high

-

North Africa and Asia, especially in EU-oriented supply chains

CBAM affects both direct exporters and companies that supply carbon-intensive inputs to EU-based manufacturers.

What Must Companies Do?

To remain competitive in the EU market, companies must:

-

Measure and report embedded emissions (e.g. Scope 1 and 2)

-

Submit CBAM declarations (voluntarily from 2023, mandatory from 2026)

-

Purchase CBAM certificates if no equivalent carbon pricing exists in their country

-

Analyze and decarbonize supply chains to minimize long-term exposure

How Haas Sustainable Consulting Supports You

We offer a strategic 3-phase pathway to CBAM compliance and long-term decarbonization. Our services include:

-

CO₂ accounting aligned with GHG Protocol, ISO 14064, and EU CBAM reporting rules

-

Technical planning for waste heat recovery, solar PV, H₂-ready systems, and high-efficiency equipment

-

Development of decarbonization roadmaps and EU-compliant documentation

-

Identification of funding options and integration into ESG and Net Zero strategies

Conclusion

CBAM is not just a regulatory obligation—it’s an opportunity to position your business as a climate-conscious leader and secure long-term access to the EU market.

The time to act is now. Use the transition period until 2026 to measure, plan, and reduce emissions—before carbon becomes a cost.